medmix delivers growth in first full year of independent operations

Ad hoc announcement pursuant to Art. 53 LR

FULL YEAR 2022 HIGHLIGHTS

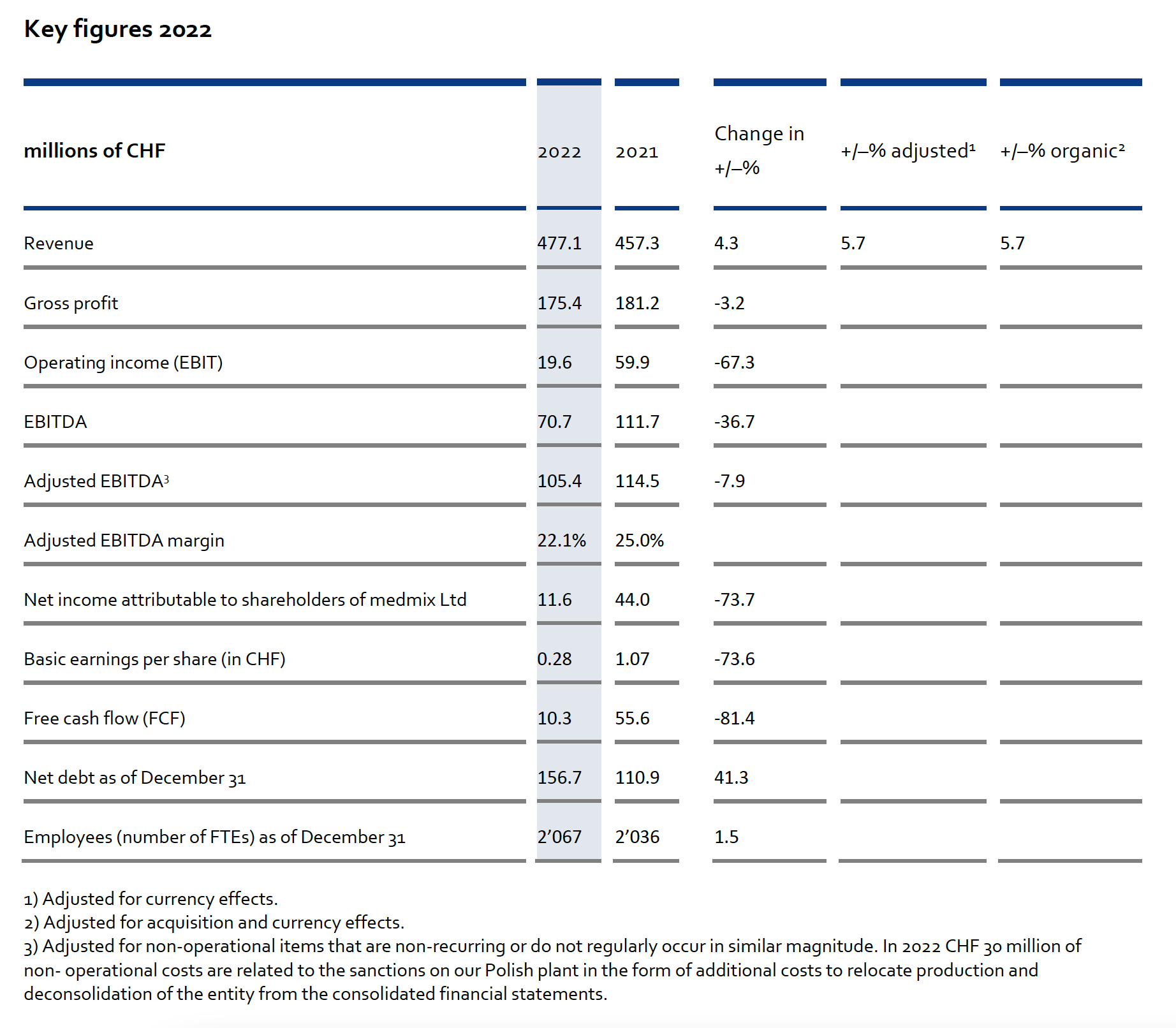

Revenue of CHF 477 m, +4% YoY (or 6% FX adjusted), above top end of revised guidance, despite normalizing demand post COVID-19

Adj. EBITDA margin of 22% (-290bps YoY) due to lag in price increases, mix and relocation of production from Poland

Free cash flow of CHF 10 m, reflecting higher inventory levels and capital investments made to minimize supply chain disruptions

Capital expenditure at 8% of revenue

Dividend of CHF 0.50 per share proposed

Launch of innovative and sustainable products including PiccoJect™ and Micro Bristle Applicator

Investments in growth: new state of the art Healthcare manufacturing facility in Atlanta, acquisition of plastics business of Universal de Suministros in Valencia, Spain, for the Industry segment; Agreement to acquire a majority stake in Qiaoyi, a Chinese beauty manufacturing business

2023 guidance: revenue up 5-7%, adj. EBITDA margin of 23%. Capital expenditure at 9% of revenue (14% of revenue including Valencia, Spain, production facility).

Mid-term: CAGR in revenue of 8%, profitability (adj. EBITDA margin) of 30%.

CEO Girts Cimermans said: “Our first complete year as an independent company was full of innovative products and commercial successes. But it was also characterized by unusual and volatile geopolitical and market conditions. Despite these challenges, we successfully accelerated growth in all segments, except for the Industry segment which was impacted by the closure of the plant in Poland. Our outlook and proposed dividend of CHF 0.50 per share reflect our confidence in normalizing demands, an improved revenue mix and a return towards full capacity with a more normalized cost base in Industry.”

Note: Unless otherwise indicated, changes from the previous year are based on currency-adjusted figures.

Note: Unless otherwise indicated, changes from the previous year are based on currency-adjusted figures.

Financial results

medmix closed the financial year 2022 with revenue of CHF 477 million, an increase of 6% compared to the previous year. Adjusted EBITDA was CHF 105 million, resulting in an adjusted EBITDA margin of 22% compared to 25% in 2021, driven by higher costs from the relocation of production, ongoing inflationary pressures where price increases are slightly lagging in time, and mix. As previously guided, the one-off impact on 2022 Net Income from the deconsolidation of the Polish legal entity was CHF 24 million and one-off costs to ramp up production outside Poland were CHF 6 million. Free cash flow was CHF 10 million, reflecting higher inventory levels and capital investments made to minimize supply chain disruptions.

Growth in both business areas

medmix grew in both its Healthcare and Consumer & Industrial business areas, despite the normalization of demand after COVID-19.

Capitalizing on the recovery in scheduled treatments and elective procedures, the Healthcare business area grew 9% and delivered CHF 185 million. Revenue in the Dental segment was up 6%, Drug Delivery was up 21% and the Surgery segment grew by 1%. The Healthcare business area now represents 39% of medmix’ revenue, up from 37% last year.

The Consumer & Industrial business area grew by 4% compared to 2021. The Beauty segment demonstrated continued post COVID-19 recovery boosted by new product launches, growing at 19% for the year. Industry revenue was 8% lower than the previous year, fully due to the temporary headwinds after the unexpected halt in production in its factory in Poland.

Outlook

In 2023, medmix anticipates continued revenue growth above market rates across all business segments. The company targets 5% to 7% growth in revenue, with demand expected to continue returning to normal market demand. Return towards full capacity and a more normalized cost base in Industry, with an improved revenue mix overall, is expected to lead to an adjusted EBITDA margin of 23%.

Due to its new production facilities in Spain and the US and planned investments in R&D, medmix indicates an elevated capital expenditure level at 14% of revenue in 2023 (9% excluding the investment in Spain). For the financial year of 2022, medmix proposes to pay a dividend of CHF 0.50 per share.

The Group’s medium-term ambition remains unchanged with revenue growing at a compound annual growth rate (CAGR) of 8% and an adjusted EBITDA margin of 30%, a target delayed in the short term by the closure of its site in Poland but reinforced in the medium term by the new set-up in Valencia. This increase in profitability is to be achieved through an increased share of revenue in the Healthcare business area, which is expected to grow faster and with higher margins than the Consumer & Industrial business area, as well as an increase in operational leverage.

Annual report online:https://report.medmix.swiss/ar22

Annual results presentation

medmix will present the annual results 2022 as a webcast on February 22 at 9:00am CET. Please note that the moderator can only take questions from dialed-in participants.

Please pre-register for the event to receive dedicated dial-in details to easily and quickly access the call:

Registration:

Webcast : https://media.choruscall.eu/mediaframe/webcast.html?webcastid=J5BffC1o

Please dial in 5 minutes before the start of the conference call.

Playback webcast

The playback of the webcast will be available shortly after the event under the same link.

Key dates in 2023

April 28 Annual General Meeting 2023

July 20 Midyear results 2023

About medmix

medmix is a global leader in high-precision delivery devices. We occupy leading positions in the healthcare, consumer and industrial end-markets. Our customers benefit from a dedication to innovation and technological advancement that has resulted in over 900 active patents. Our 14 production sites worldwide together with our highly motivated and experienced team of nearly 2’000 employees provide our customers with uncompromising quality, proximity and agility. medmix is headquartered in Baar, Switzerland. Our shares are traded on the SIX Swiss Exchange (SIX: MEDX). www.medmix.swiss

Inquiries:

Media Relations: Yasemin Diethelm, IRF

Investor Relations: Sheel Gill, Head of Investor Relations

investorrelations@medmix.com

This document may contain forward-looking statements including, but not limited to, projections of financial developments, market activity, or future performance of products and solutions containing risks and uncertainties. These forward-looking statements are subject to change based on known or unknown risks and various other factors that could cause actual results or performance to differ materially from the statements made herein.